What should Allbirds have done differently?

Many things, it turns out

Nobody feels neutrally about Allbirds. This is interesting, particularly because they make shoes that look like this:

A few weeks ago, I posted this note after

wrote that they’d just reported their worst quarter as a public company:Allbirds has had a dreadful 4 years in the public markets, and as more people chimed in with theories about where the company went wrong, I started to really wonder —could Allbirds have taken a different turn and saved itself?

If you don’t tell your own story, someone else will

Lots of people weighed in with their opinions. I agreed with most of the theories but none of them on their own felt sufficient to explain why the company is gasping for breath.

, , and attributed it to the ugly product:Other commenters mentioned the company’s business model and capital structure. I am particularly excited for

to talk about the dangers of taking a company public in his excellent newsletter. Still others mentioned the tech bro clientele, the lack of differentiation and the inconsistent quality.The variety of responses leads me to the first thing the company did wrong: it did not take the time to properly tell its story. It’s a good story! Much better than “Wharton class project-turned startup” like the common DTC narrative. This video is the founder, Tim Brown, doing his New Zealand take on the Dollar Shave Club video trope: handsome guy in constant movement speaks directly to the audience, takes shots at the legacy industry he’s disrupting while doing quirky and endearing things.

This was posted in 2016, and it was a fine start. But I am the exact demographic that should have known Allbirds’ story, and I only found out yesterday that the founder captained the New Zealand national soccer team, led them to their second World Cup, and started the company after making a minimalist shoe out of New Zealand wool and selling it to his teammates.

The founding story was not told loudly enough, and neither was the product story. Wool really is great! My mom got me these danish wool slippers1 8 years ago and they never smell bad and are so comfortable and hygge (get em while you can, not sure we can count on a Danish Slipper tariff carveout). I didn’t associate the benefits of wool with Allbirds until I started doing research for this article.

The story got away from them, and it began to be told by other people, and mostly about their customers instead of the brand itself. I believe there is something about products which rely on aesthetic taste that cannot be rushed.

’ excellent article on the time it takes to turn around a consumer brand posits that you need at least 5 years to change public perception. I think the same is true for growing a brand. When a brand grows virally in the beginning, the story becomes about the growth itself, and like a virus the social organism tends to reject the brand.Deckers, which owns UGG, Teva, and Hoka, is a useful contrast. It is currently valued at $16B. It went public in 1993 and did not cross $1B in market cap until 2007. UGG was founded in 1979, Teva in 1980. HOKA was founded in France 2009, acquired by Decker in 2013, and just began taking off in the US in earnest in 2021:

All of these brands became successful businesses on the back of differentiated and, arguably, “ugly” shoes. It can be done, but I don’t think it can be done in the time it takes to scale a software startup. Allbirds raising hundreds of millions of dollars in venture funding at over $1B valuation 3 years after it was founded was absurd, because it implied an impossible growth rate for a brand that relies heavily on public taste.

This brings me to the second thing they should have done differently: they should have distanced themselves from tech. The company launched on Kickstarter in 2016 and took off quickly in SF2, with growth there outpacing other big markets:

Dick Costolo, a tech executive old enough to know better, gave this quote to the NYT in a 2017 article about the company:

“I don’t think Silicon Valley has ever set, is currently setting, or ever will set any fashion trends,” said Mr. Costolo, the former Twitter chief executive who wears Allbirds.

That same article gave us this absolute HEATER of a “VC in 2017” quote. I can practically see Dave gesticulating with his Blue Bottle cup:

Dave Morin, an investor at Slow Ventures, which put money into Allbirds, said the start-up was a place to invest “in the material science and the dream.”

“No. 1, breakthrough material; two, you didn’t need socks, that changes the idea of shoes; and No. 3, it was a single shoe,” Mr. Morin said. “I think of it as classic Apple simplicity strategy.”

Anyway, Allbirds hitched its 🚀3 to San Francisco and tech culture. It did that right as the techlash was intensifying and tech bros were moving from “ignored” to “reviled” by popular culture. The company went public during the Covid-fueled IPO boom, but was already peaking in organic search interest in 2019 ; by 2023 the shoes were terminally uncool:

It didn’t have to be this way. Barack Obama and a host of other celebrities were spotted wearing them in the first few years. But Allbirds doubled down on SF, opening its first physical store there in 2017. Those first few years cemented the image of the company in peoples’ minds as the quintessential “enterprise SaaS shoe.”

Of course, they also shouldn’t have raised or spent money like a tech company. Their headquarters were in downtown SF, among the most expensive rents in the world. This makes sense if you need access to the best engineers to build your software company, but Allbirds ran on Shopify. They didn’t need cutting edge tech, and the business model of consumer goods can’t support the growth necessary to justify their spend. But they had the money to burn because they raised hundreds of millions from cash-drunk VCs who were seduced by the beauty of the direct to consumer model.4

The belief in that seductive business model is the original sin of Allbirds and its backers. The growth story rested on a big assumption which was proven incorrect, articulated nicely in their IPO filing in 2021:

By serving consumers directly, we cut out the layers of costs associated with traditional wholesalers, creating a more efficient cost structure and higher gross margin, which we believe allows us to deliver better products and a better experience to customers at a price point competitors would have difficulty matching.

This was true until it wasn’t. What happened with Allbirds and many of its peer companies is that they needed to acquire more and more customers, and as competition for digital ads heated up, Facebook and Google ate whatever margin the DTC competitor gained by cutting out the retailers, and then some.

Helpfully, Allbirds hired BCG to advise their turnaround efforts and illustrated this point in a 2024 strategic transformation deck:

The strategic transformation plan documents are fun to examine. A useful heuristic to see when businesspeople are operating from a place of weakness is to look at how jargon-heavy their communication is, because jargon is a mechanism for coping with insecurity. The strategy laid out in their plan is among the most jargon-y I’ve ever seen:

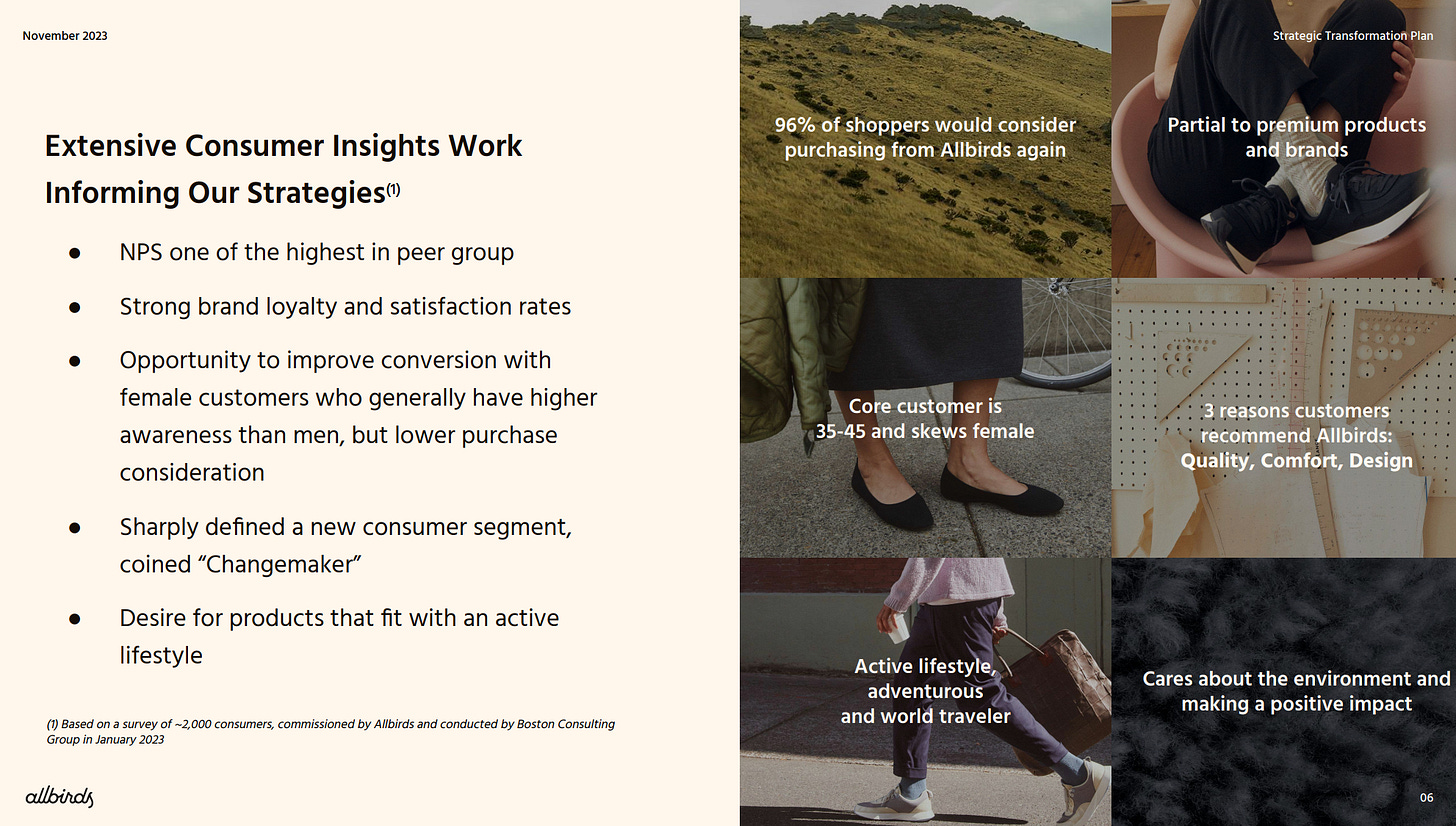

I actually don’t think all consulting is fake, and I’m sure some amount of rigor went into this, but “sharply defining a new consumer segment” (i.e. 35-45 year old women who like premium products, traveling, and sort of care about the environment) and then coining them “~Changemakers~” is an amazing grift for BCG to get paid $800k for:

Allbird’s valiant effort to drive more consideration with her does not yet seem to be bearing fruit, and I don’t think the company is long for this world5 —it made too many mistakes along the way, and the premise of growing a giant apparel brand at venture capital speed was flawed from the beginning.

But hey — maybe we’ll all be blown away when we see just how gender-differentiated those colorways are next quarter.

Thanks for reading! If you liked this post, you might like this one about Blank Street Coffee or this one about my tumultuous relationship with Sweetgreen & Chopt.

p.s. if you buy those slippers through that link you can support my revenue goals, which are much more modest than Allbirds’ were

I included Cincinnati in this chart because 1) It’s my hometown 2) Tim Brown, the co-founder of Allbirds, played college soccer there and 3) I wanted to test the apocryphal Mark Twain quote “When the end of the world comes, I want to be in Cincinnati—it’s always 20 years behind the times.” It seems like in the information age it’s more like 18 months.

I passionately hate the rocketship emoji and it was painful to put it here but it felt appropriate for the subject matter

There is a similar dynamic in media; I wrote about how Substack is playing the role of the distributor here.

As always, this isn’t financial advice, i’m just some guy, etc. You should take my advice about those slippers, though

you’re so right about the brand story getting away from them. I didn’t know anything about the founder being from New Zealand, I thought they literally came from San Francisco. Your post also made me realize something else. I think the blandness is also a problem, the shoes don’t have a stylistic point of view. Shoes are potent markers of identity. Besides watches they telegraph more about our personality, professions, and values than almost any other garment or accessory. If a shoe is really bland looking while also being associated with an industry that’s universally distrusted? Problem. Crocs are disgusting but they fit in the “main character energy” era where people care about their own comfort above all else or being an “individual” with the heinous little charms you stick in the holes. Thanks for the shoutout!

"jargon is a mechanism for coping with insecurity"

nicely put 👏