The most astonishing thing I’ve learned this week has been that when Fox News took off in the early 2000s, people would call in to let them know that the logo was burned into the glass on their TV because they had the channel on so much. Apparently this was still happening in 2018 (I expect with older TVs):

The new season of the excellent podcast Slow Burn investigates the rise of Fox News. Slow Burn does a wonderful job immersing you in whatever story they’re telling, so I’ve been walking around brooklyn, enjoying the beautiful fall weather, lost in the world of 1990s cable news drama. This has been particularly poignant as we’re three weeks from the election and no matter the outcome, Fox News will have played an outsized role in it.

It’s been interesting from a sociological and business perspective and rather chilling to me from a political perspective. It’s really underscored to me how journalism is pretty fundamentally misaligned with capitalism; it does not seem like reporting news responsibly is necessarily the best business strategy, especially on inherently “entertaining” mediums like TV.

Roger Ailes built Fox News on the premise that American news networks all produced content with a liberal bias for an audience of elites that were out of touch with what “mainstream America” wanted.

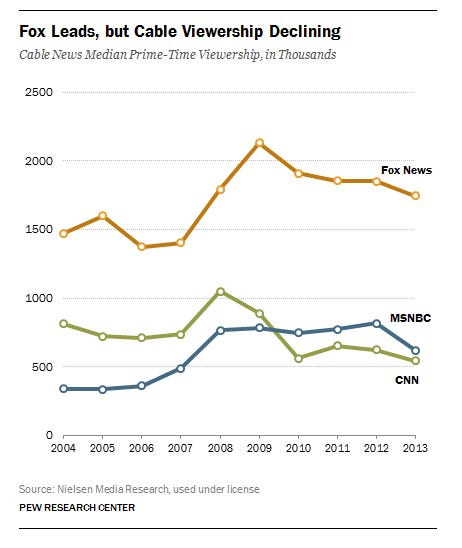

His intuition was apparently correct, and Fox grew to dominate cable news:

The network’s rise followed a pattern of disruption that repeats itself across industries:

Large incumbents dominate an industry and develop blind spots in the market that they cannot or will not address. This seems more likely to happen in industries with high barriers to entry and in industries with mass markets (like media or CPG), because the people creating the product at headquarters cannot possibly understand the entire consumer base. In Fox News’ case, ABC, NBC, CBS, and CNN occupied roughly the same part of the political spectrum and survived without needing to differentiate. Producing & distributing media in the ‘90s was costly and so the incumbent networks had a powerful moat shielding them from competition. And even though TV news is a mass market product, the journalist and executives tended to be liberal and clustered in a few big cities, so their content probably was misaligned to big parts of the market.

New entrant emerges to address the market need that the incumbents are ignoring. The new entrant is often aided by a a technological or market structure change. The rise of Cable TV made it easier to launch a network, and Roger Ailes recognized that the existing media outlets were not appealing to a large segment of the market (conservative viewers and people who felt alienated by traditional media).

If the new entrant is successful, it grows and lasts long enough to become a large, out of touch incumbent which risks being disrupted by a new entrant. Fox News is still huge and successful but its growth is threatened by new “news” networks that are willing to say even more extreme things than Fox is (OAN, Newsmax below) or any number of independent podcasts, youtube channels, or newsletters which have sprung up because the barriers to entry to producing and distributing media have plummeted:

Cultural Arbitrage

A commonly studied form of disruption is where a company’s business model does not let it address a certain market segment. For example, it was difficult for Procter & Gamble to sell deodorant online (DTC) because it would make Walmart mad and Walmart controls a huge portion of P&G’s distribution. So Procter & Gamble’s hands were tied economically: they would have to cannibalize their existing business to enter the new business of e-commerce.

Fox’s type of disruption, in which the incumbent’s culture prevents it from addressing a market, is interesting in a different way. It seems like any one of the existing news networks could have moved to the right and captured that market instead of Fox, and it probably would have been economically rational to do so. But they did not because their cultures rejected it: morally or simply because most of the people in the organizations shared worldviews that did not align with Roger Ailes’ worldview. And so Ailes was able to come in and capture this huge market for sensationalist conservative news.

These are a couple of other examples of this sort of “culture arbitrage” that come to mind, in which big incumbents are disrupted because their cultures don’t allow them to serve certain markets:

Big beauty companies like L’Oreal and Estée Lauder underserving people of color when producing beauty products; as it became cheaper to launch a consumer brand, new entrants like Mented and Pattern Beauty emerged to address this need

ESPN took itself too seriously, did not produce enough content for younger consumers and gave an opening to Barstool Sports to come in and win with irreverence

White-shoe Wall Street firms viewed junk bonds as a disreputable part of the market lacking in prestige, which gave Michael Milken an opportunity to build a hugely profitable junk bond trading business at Drexel Burnham Lambert; The Predators’ Ball is a fun book about this

The only ways I can think of to prevent this type of complacency for big companies is to continuously talk to customers and to hire people from different backgrounds.

If you’re interested in this, I highly recommend Slow Burn - reach out and let me know what you think! Their season about Bill Clinton’s impeachment is also fascinating, and made me think much worse of Clinton as a person.

Great post. With a lot to think over. I will listen to Slow Burn