I’ve been trying to reason through the economic implications of rapid progress in AI. It ties my brain in knots quickly, and I thought it’d be helpful to work through an example.

I initially assumed that companies directly using AI would benefit and become much more valuable. But I’m increasingly thinking about this passage from the Charlie Munger book (you can read it for free online here, highly recommend):

The great lesson in microeconomics is to discriminate between when technology is going to help you and when it’s going to kill you. And most people do not get this straight in their heads. But a fellow like Buffett does. For example, when we were in the textile business, which is a terrible commodity business, we were making low-end textiles, which are a real commodity product. And one day, the people came to Warren and said, “They’ve invented a new loom that we think will do twice as much work as our old ones.” And Warren said, “Gee, I hope this doesn’t work—because if it does, I’m going to close the mill.” And he meant it.

What was he thinking? He was thinking, “It’s a lousy business. We’re earning substandard returns and keeping it open just to be nice to the elderly workers. But we’re not going to put huge amounts of new capital into a lousy business.” And he knew that the huge productivity increases that would come from a better machine introduced into the production of a commodity product would all go to the benefit of the buyers of the textiles. Nothing was going to stick to our ribs as owners.

If general, human-like intelligence becomes extremely cheap, that is a lot like a new loom doing twice (or two hundred) times as much work as the old ones. But instead of applying to a specific process like textile manufacturing, it applies to all the endeavors where human intelligence is a key input.

In the same way the benefits of the textile machine would go to consumers in the form of cheaper textiles, it seems like AI could be hugely deflationary.

AI’s potential impact on a hypothetical data analyst

Let’s consider Jonah, a hypothetical data analyst at Netflix. His job requires some intelligence — writing little computer programs to extract and process data, learning about the company’s business, and making coherent recommendations to its management.

But he’s also a little bit sleepy sometimes, and drinks a borderline absurd quantity of sparkling water at the office, and the company has to pay him and give him little perks and time off to keep him happy. So sometime in 2026 they decide management can use Google’s built-in AI capabilities to analyze all the data flowing through their app and it’ll be roughly the same quality as Jonah’s analyses, and about 50 times cheaper, so they lay him off, along with 800 other employees in similar technical roles.

It turns out the AI works pretty well and Netflix finds it can continue innovating and building a better music streaming product even though it has cut its operating costs by 30%. Great! But, its competitors have access to the same technology and have made similar workforce reductions to cut costs. Amazon has been especially aggressive on cost-cutting and passing on these savings to consumers: it has continued to add expensive content like NFL games its Prime Streaming bundle while keeping the price the same.

So, Netflix must keep its prices low and even offer promotions for consumers to join to compete with its competitors.

At the same time, Jonah is feeling the squeeze of being unemployed, and cuts his spending a lot. He gets rid of his Amex, and he cancels a bunch of subscriptions. This is an added deflationary pressure to Netflix — with a lot of white collar workers facing job insecurity, a big part of their customer base will become much more price sensitive.

So, we have two deflationary factors:

Netflix’s competitors all have access to the same technology and can use it to offer cheaper products

Workers getting laid off means they are less willing to pay for Netflix.

And since AI is a broad, general purpose technology that is moving quickly, it seems like these factors could be very large and dramatic.

Of course, Netflix and its competitors will also have to pay more for compute as they invest into AI and as energy and computational power become more coveted. So that will be inflationary and may counterbalance the deflationary pressure (although in this case, Amazon would be particularly advantaged relative to Netflix because they own a lot of compute with AWS and will be able to use it more cheaply).

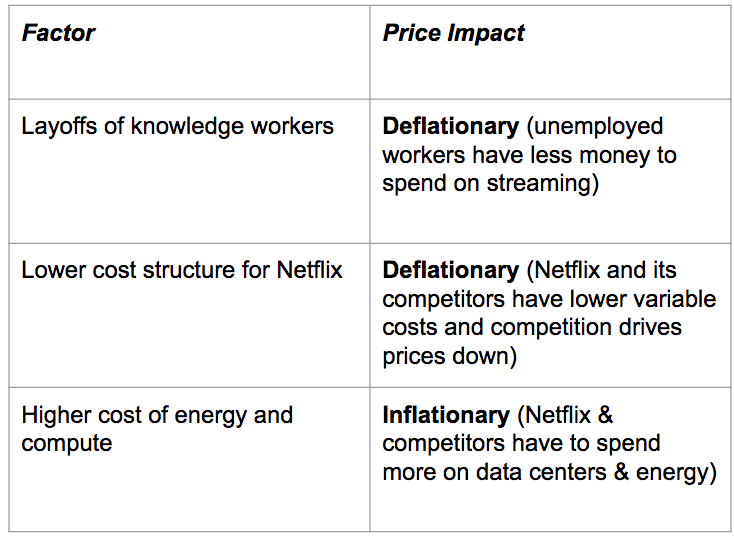

To summarize, this is what I see as the impact of AI on Netflix’s pricing:

So it feels to me that for a business like Netflix where most of the variable costs are people, the benefits will not “stick to the company’s ribs,” to use Munger’s phrase. Instead, they’ll be forced to pass on the savings to consumers, in the form of more and more content for lower prices.

So, Jonah might be able to afford to keep watching Netflix after they lay him off. Maybe he’ll get a job as a bartender, start painting, raise some chickens…not a bad life.

Also, you should post these links on Twitter :)

Very interesting thought experiment. As I think through this, the deflationary cycle would happen only if most workers were tech workers. This is not true and all the carpenters and plumbers should benefit from technology costs going down. Would the ripple effect of knowledge economy collapsing be too much to cope? I don't know. Recently saw a tweet that language models are horrible at doing scientific research. Maybe these tech workers can focus more on stuff like research.

My own feeling: AI will do what computers did 30 years ago and massively improve productivity and bring wealth to societies.